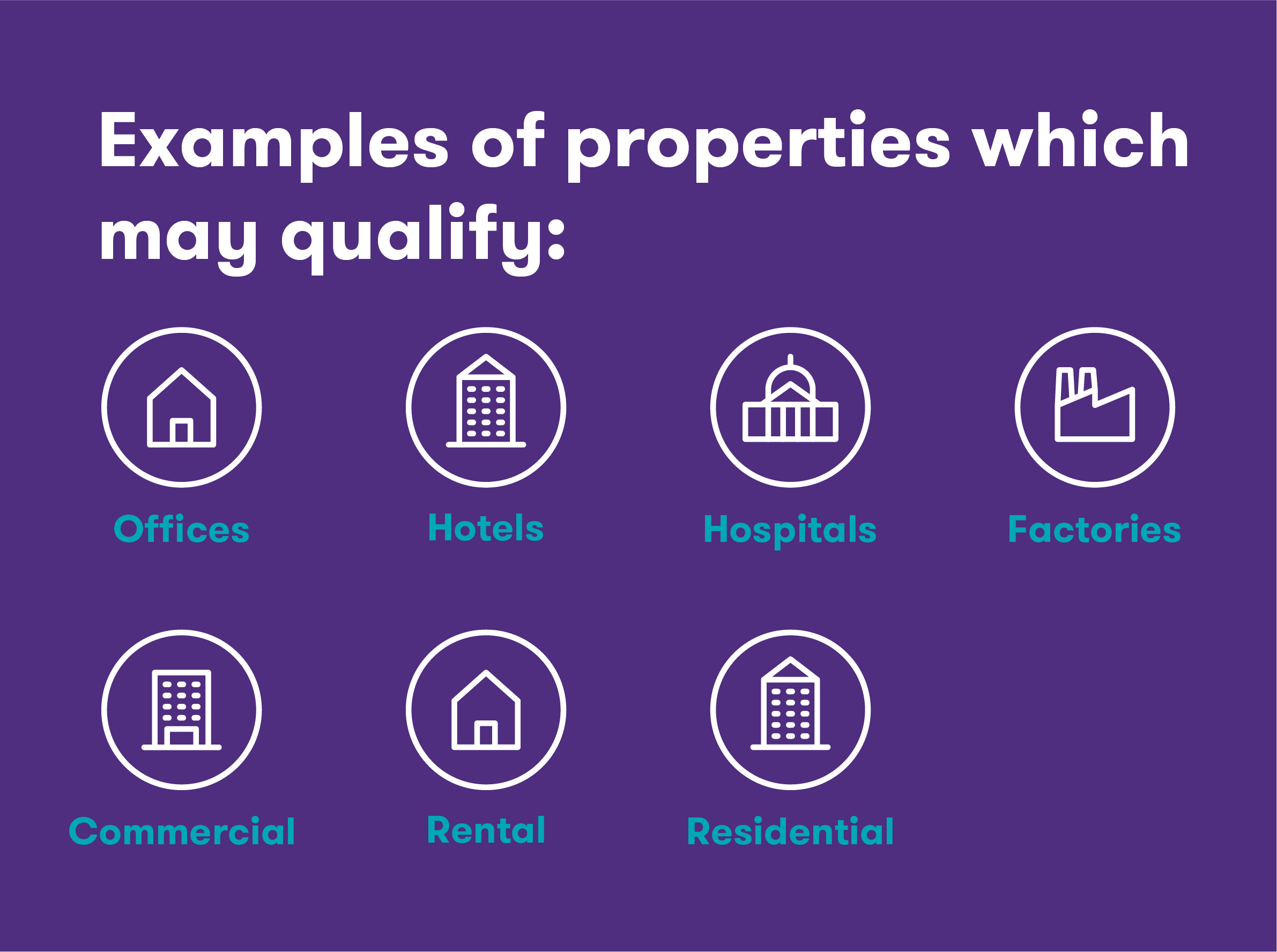

Fixtures And Fittings Capital Allowances . Including allowances for structures, buildings, plant. The value of the allowances comes from fixtures in the property. The key point here is to. Web guidance and forms covering how to claim capital allowances. Items classed as peffs are embedded in the Web what are property embedded fixtures & fittings? Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by.

from www.grantthornton.ie

The value of the allowances comes from fixtures in the property. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. The key point here is to. Web guidance and forms covering how to claim capital allowances. Web what are property embedded fixtures & fittings? Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Including allowances for structures, buildings, plant. Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital.

Capital Allowances Grant Thornton

Fixtures And Fittings Capital Allowances Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Web guidance and forms covering how to claim capital allowances. The key point here is to. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. The value of the allowances comes from fixtures in the property. Including allowances for structures, buildings, plant. Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web what are property embedded fixtures & fittings? Items classed as peffs are embedded in the

From www.linkedin.com

Capital Allowances Furniture, Fixtures and Equipment Expenditure Fixtures And Fittings Capital Allowances Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Including allowances for structures, buildings, plant. Items classed as peffs are embedded in the Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. The value of the allowances comes from. Fixtures And Fittings Capital Allowances.

From accotax.co.uk

Capital Allowances n Fixtures & How To Fix It? Accotax Fixtures And Fittings Capital Allowances Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. The value of the allowances comes from fixtures in the property. Including allowances for structures, buildings, plant. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. Web capital allowances provide. Fixtures And Fittings Capital Allowances.

From www.propertycapitalallowance.com

The Concept of PEFFs Capital Allowance Review Service Fixtures And Fittings Capital Allowances The key point here is to. Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web what are property embedded fixtures & fittings? Items classed as peffs are embedded. Fixtures And Fittings Capital Allowances.

From fitnessretro.blogspot.com

Integral Fixtures And Fittings Capital Allowances FitnessRetro Fixtures And Fittings Capital Allowances Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. The key point here is to. Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. The value of the allowances comes from. Fixtures And Fittings Capital Allowances.

From slideplayer.com

CAPITAL ALLOWANCES By Associate Professor Dr. GholamReza Zandi ppt Fixtures And Fittings Capital Allowances Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Items classed as peffs are embedded in the Including allowances for structures, buildings, plant. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. The key point. Fixtures And Fittings Capital Allowances.

From www.grantthornton.ie

Capital Allowances Grant Thornton Fixtures And Fittings Capital Allowances Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation. Fixtures And Fittings Capital Allowances.

From www.taxation.co.uk

Capital allowances claims for property fixtures Taxation Fixtures And Fittings Capital Allowances The value of the allowances comes from fixtures in the property. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Items classed as peffs are embedded in the Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web guidance and forms covering how. Fixtures And Fittings Capital Allowances.

From www.accountancyage.com

Capital allowances a stepbystep guide Accountancy Age Fixtures And Fittings Capital Allowances Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Including allowances for structures, buildings,. Fixtures And Fittings Capital Allowances.

From www.youtube.com

Capital Allowances (part 3) ACCA Taxation (FA 2022) TXUK lectures Fixtures And Fittings Capital Allowances Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web guidance and forms covering how to claim capital allowances. The key point here is to. Web. Fixtures And Fittings Capital Allowances.

From ukba.co.uk

Capital Allowances for Property Embedded Features, Fixtures and Fixtures And Fittings Capital Allowances Including allowances for structures, buildings, plant. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. The value of the allowances comes from fixtures in the property. Web what are property embedded fixtures &. Fixtures And Fittings Capital Allowances.

From fitnessretro.blogspot.com

Integral Fixtures And Fittings Capital Allowances FitnessRetro Fixtures And Fittings Capital Allowances Items classed as peffs are embedded in the The value of the allowances comes from fixtures in the property. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. The key point here is to.. Fixtures And Fittings Capital Allowances.

From fitnessretro.blogspot.com

Integral Fixtures And Fittings Capital Allowances FitnessRetro Fixtures And Fittings Capital Allowances Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Including allowances for structures, buildings, plant. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently. Fixtures And Fittings Capital Allowances.

From www.thedirectorschoice.com

What are Capital Allowances? The Directors Choice Fixtures And Fittings Capital Allowances Web guidance and forms covering how to claim capital allowances. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. The key point here is to. Including allowances for structures, buildings,. Fixtures And Fittings Capital Allowances.

From www.slideserve.com

PPT Capital Allowances An Overview PowerPoint Presentation, free Fixtures And Fittings Capital Allowances Web guidance and forms covering how to claim capital allowances. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. The key point here is to. Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. Property embedded fixtures and fittings. Fixtures And Fittings Capital Allowances.

From www.studocu.com

Capital Allowances Practice Materials for the Finance Unit Capital Fixtures And Fittings Capital Allowances Web guidance and forms covering how to claim capital allowances. Items classed as peffs are embedded in the Web broadly, it lets allowances go to a person who incurs expenditure on the provision of a fixture, either on installation or by. Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most. Fixtures And Fittings Capital Allowances.

From www.mondaq.com

Capital Allowances Recent Changes to Rates, Thresholds etc Tax UK Fixtures And Fittings Capital Allowances The key point here is to. Items classed as peffs are embedded in the Web guidance and forms covering how to claim capital allowances. Property embedded fixtures and fittings or peffs for short, are an aspect of capital allowances that are frequently missed. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web. Fixtures And Fittings Capital Allowances.

From www.studocu.com

Capital allowances 2 They are the tax equivalent of the accounting Fixtures And Fittings Capital Allowances The value of the allowances comes from fixtures in the property. Web fixtures and fittings are integral components of commercial properties, and correctly identifying and claiming capital. Web where a uk taxpayer invests capital in building, buying, refurbishing or fitting out a commercial property, they will usually. Including allowances for structures, buildings, plant. Web capital allowances provide tax relief for. Fixtures And Fittings Capital Allowances.

From eshop.taxaccounts.ie

IE Capital Allowances Template Accountant's Fixtures And Fittings Capital Allowances Web capital allowances provide tax relief for the depreciation of certain capital assets, principally plant or machinery, including most fixtures in a building used. The value of the allowances comes from fixtures in the property. Web what are property embedded fixtures & fittings? Items classed as peffs are embedded in the Property embedded fixtures and fittings or peffs for short,. Fixtures And Fittings Capital Allowances.